Table of Contents

- VOO Review: Is VOO a Good ETF to Invest In? - Thoughtful Finance

- VTI vs VOO: A Comparison of Two Vanguard ETFs

- VOO Stock Price and Chart — AMEX:VOO — TradingView

- VOO Stock Price Forecast 2023-2030 | VOO Stock Price Prediction 2030

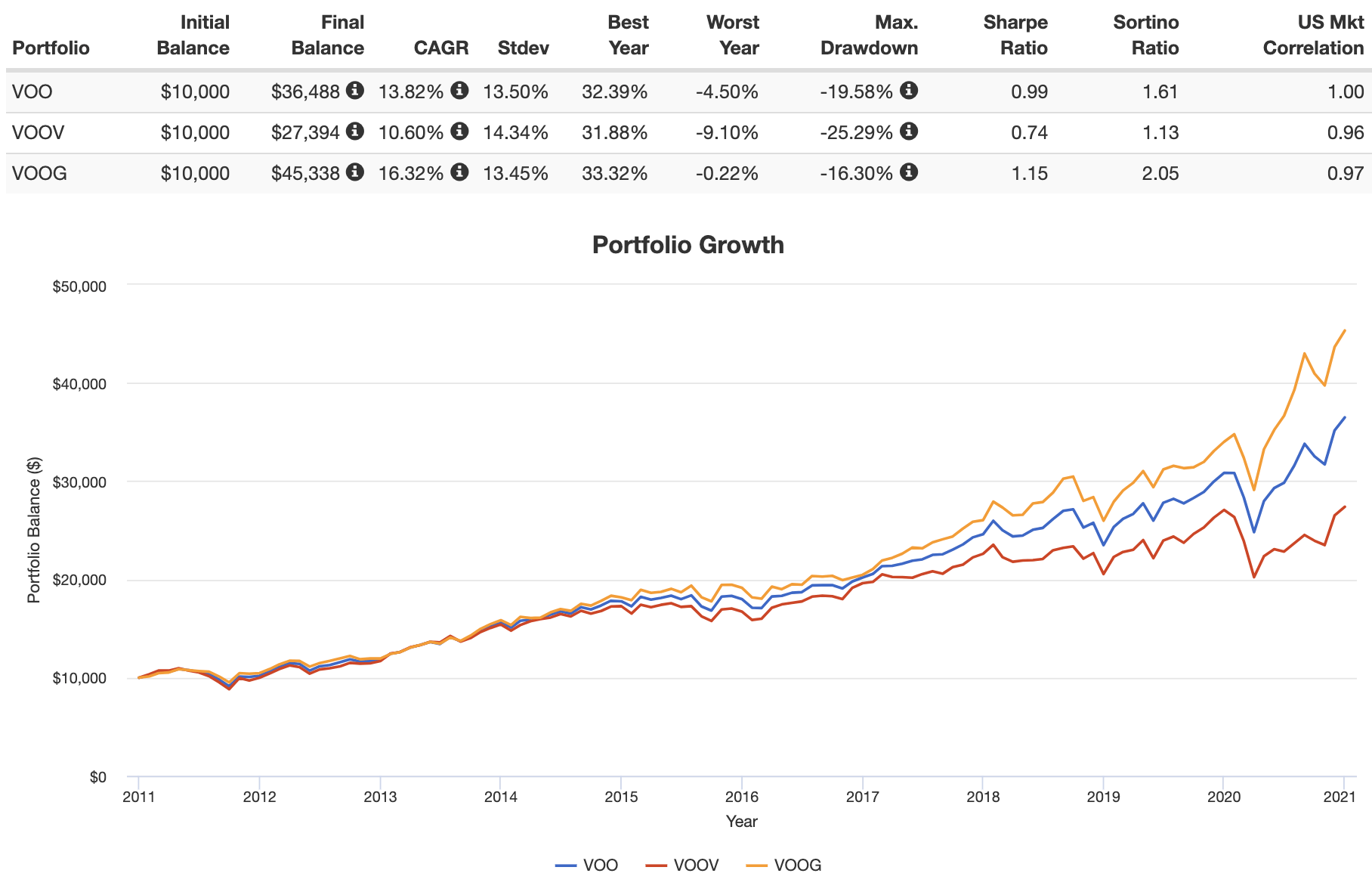

- VOO vs. VOOV vs. VOOG - Vanguard S&P 500, Value, or Growth?

- VOO vs VTI: An Easy Way to Choose Between an S&P 500 and Total Stock ...

- Voo Dividend 2025 - Alyson Laurel

- VOO Stock Forecast - 2024, 2025, 2028, 2030, 2035

- VOO Stock Fund Price and Chart — AMEX:VOO — TradingView

- 미국 인기 ETF 주식 5개 종목 - 불주사

Introduction to VOO

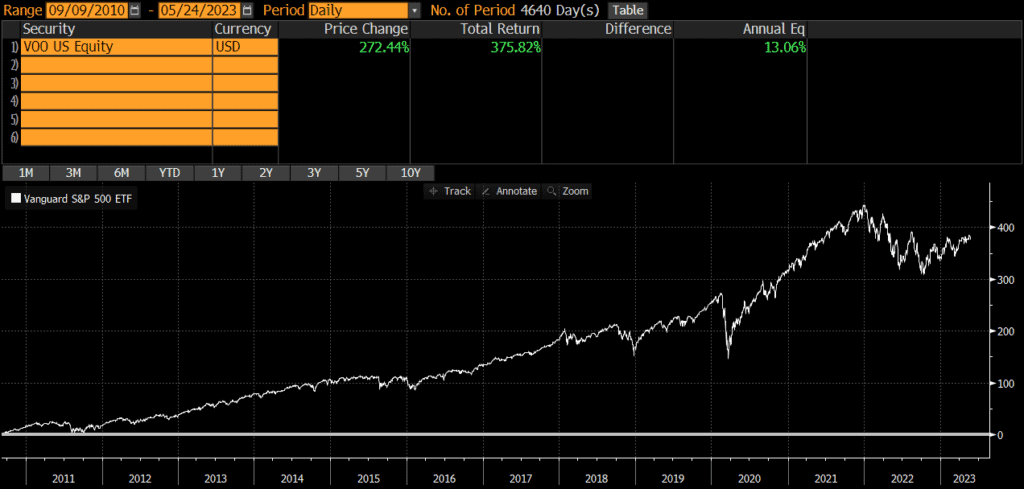

Historical Performance

Here is a breakdown of VOO's historical performance:

- 1-year return: 25.1%

- 3-year return: 14.1%

- 5-year return: 15.6%

- 10-year return: 13.5%

Key Drivers of Performance

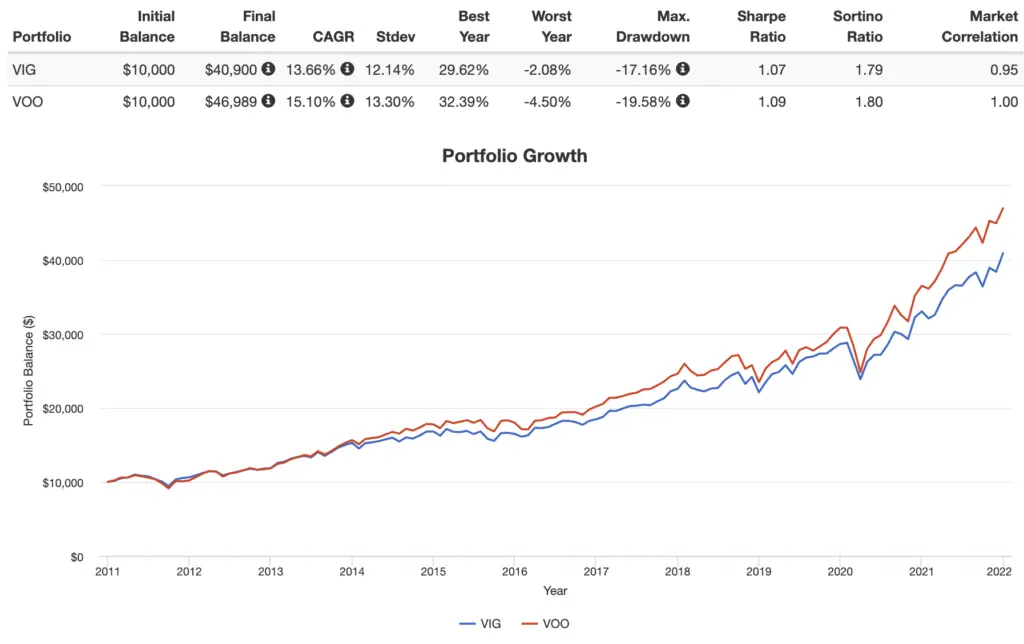

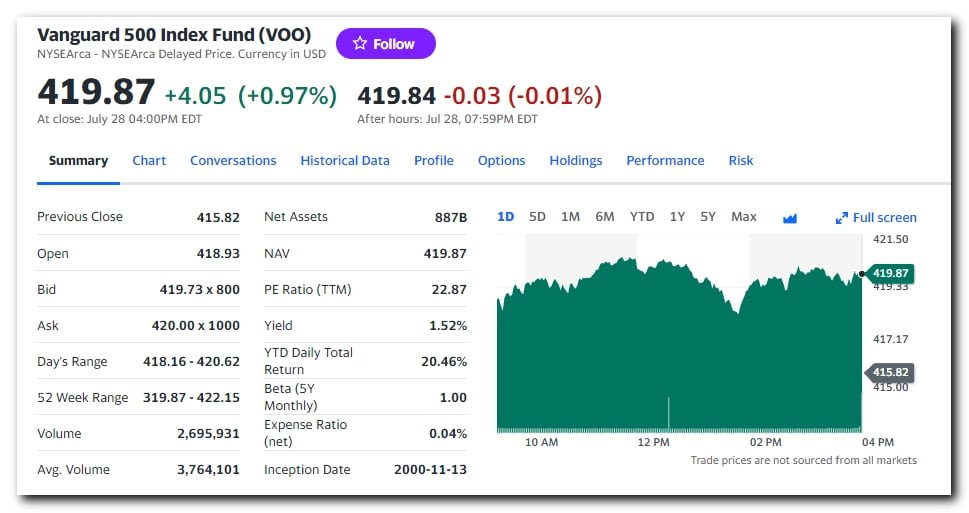

Several factors have contributed to VOO's strong performance over the years. These include: Diversification: By holding a broad portfolio of 500 stocks, VOO provides investors with instant diversification, reducing exposure to individual stock risk. Low costs: VOO's low expense ratio of 0.04% means that investors can keep more of their returns, rather than paying high fees to fund managers. Tracking error: VOO has a low tracking error, meaning that it closely follows the performance of the S&P 500 Index, minimizing deviations from the benchmark. The Vanguard S&P 500 ETF (VOO) has established itself as a reliable and low-cost way to gain exposure to the US stock market. With its strong historical performance, broad diversification, and low costs, VOO is an attractive option for investors seeking to build a long-term portfolio. While past performance is not a guarantee of future results, VOO's track record suggests that it can be a valuable addition to a diversified investment strategy. As with any investment, it's essential to conduct thorough research and consider your individual financial goals and risk tolerance before investing in VOO or any other ETF.Source: Yahoo Finance

Note: The data and information in this article are subject to change and may not reflect the current market situation. It's always recommended to consult with a financial advisor or conduct your own research before making investment decisions.